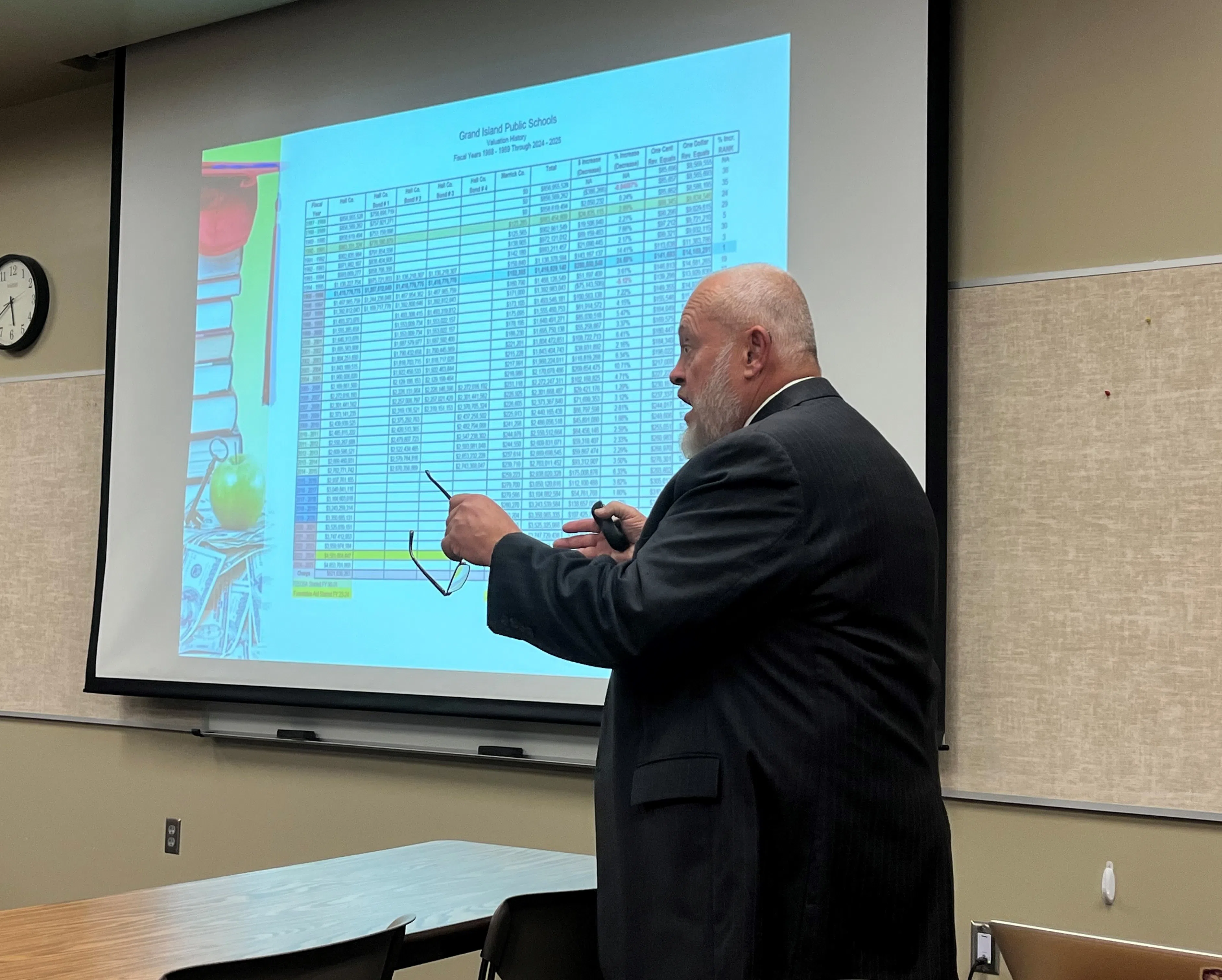

Grand Island Public Schools Chief Financial Officer Virgil Harden gives a presentation to the Board of Education at a budget workshop on Sept. 19, (Carol Bryant, Central Nebraska Today)

GRAND ISLAND – The Grand Island Public Schools Board of Education had a budget workshop and two public hearings in the evening Aug. 19 concerning the 2024-25 budget.

Chief Financial Officer Virgil Harden gave presentations at the meetings. No one from the public was present to speak at either public hearing.

The budget workshop lasted approximately one hour.

Harden said after the meeting that per $100,000 of valuation, a property owner will pay $1,117.70 in property taxes.

He distributed a page to Board members listing key provisions of the 2024-25 budget:

*The overall general fund budget has increased by 3.61 percent.

*The property tax valuation has increased by 5.94 percent.

*The property tax asking has increased 3.84 percent.

*The school district reduced $4.5 million from spending.

*General Fund cash reserves are at ideal targeted levels.

*He is working on a tender offer in the Bond Fund to save money.

*The 2024-25 budget includes investments in staff (including benefits); safety and security; curriculum and instruction; and poverty and English Language Learners.

*The school district plans to actually spend $135 million in the General Fund in 2024-25.

*Harden wrote, “GIPS will live within our means.”

For this point in time, Harden said, “We’re exactly where we should be with our ending cash” from 2023-24.

For the budget workshop, Harden gave Board members a 25-page handout with three slides per page. A number of the pages had spreadsheets with text in very fine print.

For 2023-24, available funds were $171,612,312. Expenditures totaled $137,798,440. The ending balance was $33,813,871. The change in the General Fund balance was $5,996,588.

The handout contained information about the General Fund, Depreciation Fund, Employee Benefit Fund, Contingency Fund, Activities Fund, School Nutrition Fund, Bond Fund, Special Building Fund, Qualified Capital Purpose Undertaking Fund, Cooperative Fund, and Student Fee Fund.

Harden wrote, “In my professional opinion, GIPS should start now setting the groundwork for a Bond Referendum for a vote within the next 36 to 48 months (i.e. ideal vote date is Tuesday, Sept. 12, 2028). He did not specify for what project(s) the bond money would be used.

For the Depreciation Fund, Employee Benefit Fund, and Activities Fund there are no changes from 2023-24 to 2024-25. For the Contingency Fund, there is a $100,000 change from FY 2023-24 to FY 2024-25. For the Activities Fund, significant cost drivers are transportation, equipment, and students in poverty.

In the School Nutrition Fund, there is a $700,000 decrease from 2023-24 to 2024-25. “The biggest challenge for the Child Nutrition Fund in FY 2024-25 is the districtwide Community Eligibility Provision. For the Community Eligibility Provision, it allows schools in low-income areas to serve free meals to all students without collecting applications for free and reduced-price meals.

For the Bond Fund, there is a $56.9 million increase from 2023-24 to 2024-25. In the Special Building Fund, there is no change from 2023-24 to 2024-25. In the Qualified Capital Purpose Undertaking Fund, there is an $8 million increase from 2023-24 to 2024-25. For the Cooperative Fund, there are no changes from 2023-24 to 2024-25.